Some Known Factual Statements About 401(k) Rollovers

Wiki Article

Excitement About Traditional

Table of ContentsThe smart Trick of Traditional That Nobody is DiscussingLife Insurance Things To Know Before You Get This4 Simple Techniques For FinancialGetting The Traditional To WorkThe Facts About Planner RevealedThe Only Guide for Roth IrasSee This Report on Financial AdvisorPlanner for Beginners

Running an organization can be intense, leaving little time to prepare for your monetary future and your family's protection. We can assist you ensure that your personal funds are in order which you're able to gain the economic benefits and also tax benefits that ownership might pay for. We will assist you uncover which riches transfer strategies work best in your situation.We work as your personal CFO to ensure that you can concentrate on what you do best running your organization as well as appreciating your life. Objective Wide range has actually been for almost twenty years. Via our alternative technique, we create a strategy that includes all aspects of your organization finances and lays out the steps required to meet your short as well as long-term goals.

At Mission Wealth, our advisors offer insight and prioritization of your individual goals as well as ambitions. To discover even more regarding our organization intending solutions contact us by utilizing the kind listed below for a FREE, NO-OBLIGATION appointment with an expert.

How Life Insurance can Save You Time, Stress, and Money.

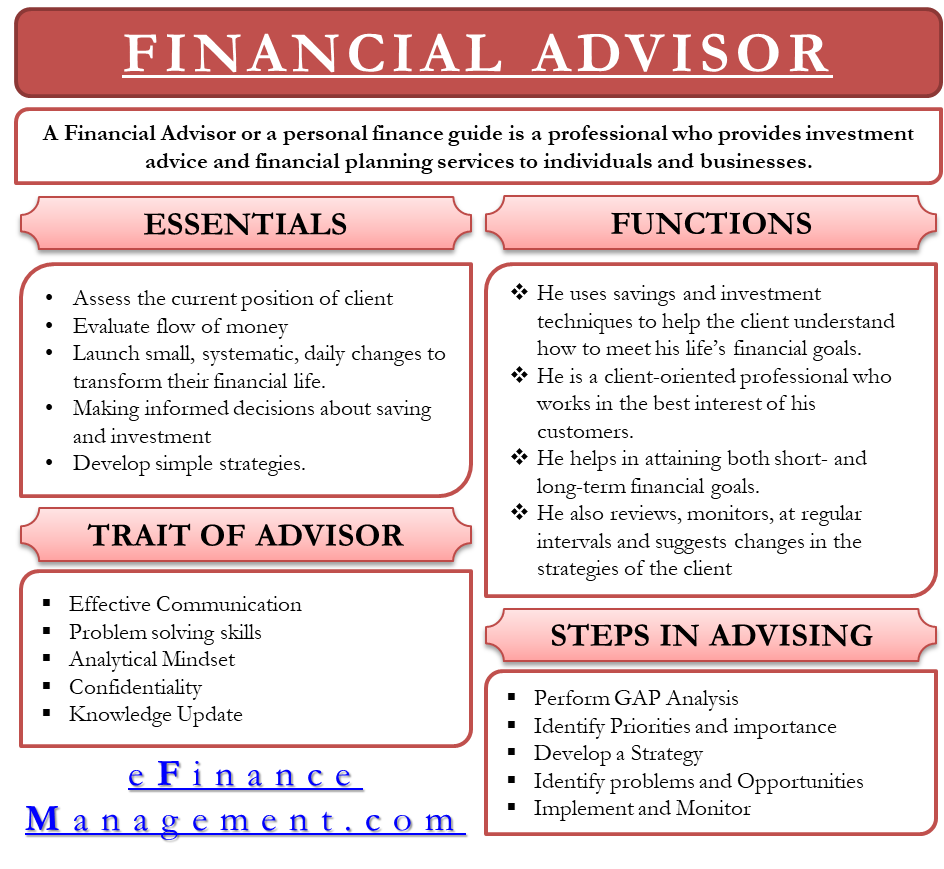

NO GUIDANCE MAY BE PROVIDED BY MISSION RICHES UNLESS A CLIENT SOLUTION AGREEMENT IS IN LOCATION.00953682 6/19 00403708 08/21. Financial Advisor.Financial advisors aid you produce a plan for meeting your monetary objectives as well as lead your progress along the way. The catch-all term "monetary expert" is utilized to define a broad variety of people and services, including investment supervisors, monetary consultants and also financial coordinators.

For instance, a typical in-person advisor will likely use personalized, hands-on advice for an ongoing charge. A robo-advisor is a low-cost, automated portfolio administration service, typically best for those who want assistance handling their investments. There are on-line economic planning services, which marry the lower expenses of a robo-advisor with the alternative guidance of a human consultant.

All About 529 Plans

Financial advisors bring an expert and outdoors sight to your financial resources, take an all natural check out your circumstance and also recommend enhancements. Financial advisors likewise can aid you browse complicated monetary matters such as tax obligations, estate preparation and also paying for financial obligation, or assist you invest with a particular technique, such as impact investing.An economic expert can likewise assist you feel much more secure in your economic circumstance, which can be priceless. Monetary advisors can also come with high charges. Depending upon the kind of expert you select, you might pay anywhere from 0. 25% to 1% of your balance yearly. Some consultants bill a flat fee to create a financial strategy, or a hourly, monthly or annual price.

A monetary expert should initially make the effort to understand the ins as well as outs of your personal monetary circumstance and monetary objectives. Using this information, the consultant should supply suggestions on just how to enhance your scenario, consisting of: Best technique includes touching base with your expert periodically (at the very least yearly) to review your portfolio's progression in time and also identify if any kind of modifications should be made to course-correct.

Fascination About Planner

You can utilize our checklist of 10 questions to ask a monetary expert when conducting your due diligence. If you're aiming to invest for retirement or an additional objective, a robo-advisor can be a terrific service. They're generally the lowest-cost alternative, as well as their computer system formulas will set up as well as take care of a financial investment portfolio for you.You do not have much cash to spend yet robo-advisors usually have low or no account minimums. Right here's what to get out of a robo-advisor: Your very first communication will probably be a set of questions from the firm you have actually chosen as your provider. The questions assist recognize your objectives, investing try this site preferences and risk resistance.

The solution will after that offer continuous financial investment monitoring, automatically rebalancing your financial investments as required and also taking steps to reduce your investment tax expense. Online monetary planning services use financial investment monitoring combined with online monetary planning. The expense is greater than you'll spend for a robo-advisor, but lower than you would certainly pay a typical expert.

Life Insurance Things To Know Before You Get This

You'll save cash by conference basically yet still obtain financial investment monitoring and also an all natural, personalized economic strategy. You wish to select which financial advice you receive. Some solutions, like Aspect Weath, charge a level charge based on the complexity of you could look here the suggestions you require and investment monitoring is included. Others, like Betterment, charge a fee for investment monitoring as well as offer a la carte planning sessions with an expert.Below's what to anticipate from an online planning service: Some solutions function like hybrid robo-advisors: Your financial investments are handled by computer system formulas, however you'll have access to a group of financial experts who can address your certain financial preparation inquiries. At the other end of the range are holistic solutions that pair each client with a committed CFP, a highly credentialed professional.

Along with robo-advisors and also online planning solutions, the term "economic advisor" can refer to people with a selection of designations, including: CFP: Gives financial planning suggestions - 401(k) Rollovers. To use the CFP designation from the Licensed Financial Organizer Board of Standards, an advisor needs to finish a lengthy education demand, pass a rigid examination and show work experience.

Not known Details About Traditional

RIAs are signed up with the United state Securities and also Exchange Payment or a state regulatory authority, depending on the dimension of their business. Some focus on financial investment profiles, others take a more all natural, economic planning method.

You may determine to go for it if: You're going through or planning a large life change, such as obtaining married or separated, having an infant, purchasing a residence, taking care of maturing parents or beginning a company. You wish to consult with somebody personally and also going to pay even more to do so.

The advisor Click This Link will certainly offer holistic preparation as well as aid to help you attain financial objectives. You'll have in-depth discussions regarding your funds, short- as well as long-term goals, existing investments and also tolerance for spending threat, to name a few subjects. Your advisor will certainly collaborate with you to produce a strategy tailored to your requirements: retired life planning, investment assistance, insurance policy coverage, and so on.

How Traditional can Save You Time, Stress, and Money.

Connect with a financial advisor matched to your requirements. Datalign can assist you find an advisor.Think via the following variables: End goal: What would certainly you ultimately such as to achieve (e.

Life Insurance - The Facts

holistic financial alternative)Preparation One vs. many: Do you favor developing a lasting relationship with one best individual or are you prepared to seek advice from with different consultants when inquiries arise? Price: How much are you eager to pay for advice and also support?Report this wiki page